Australia pops new champagne record in 2017

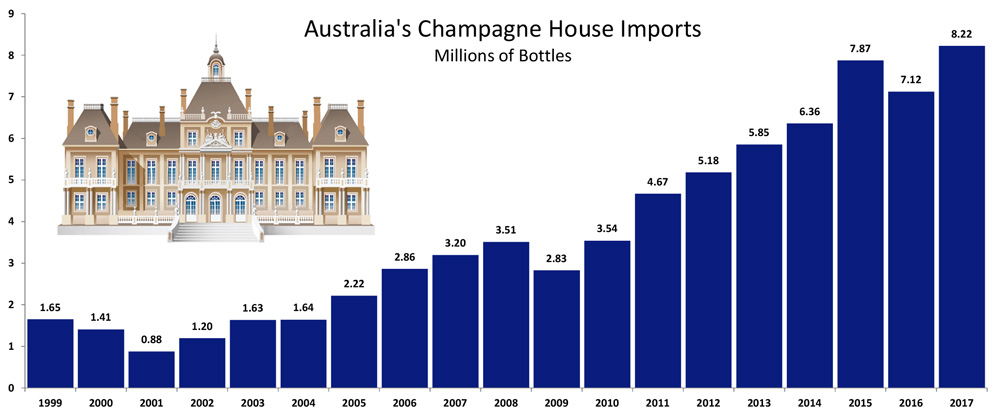

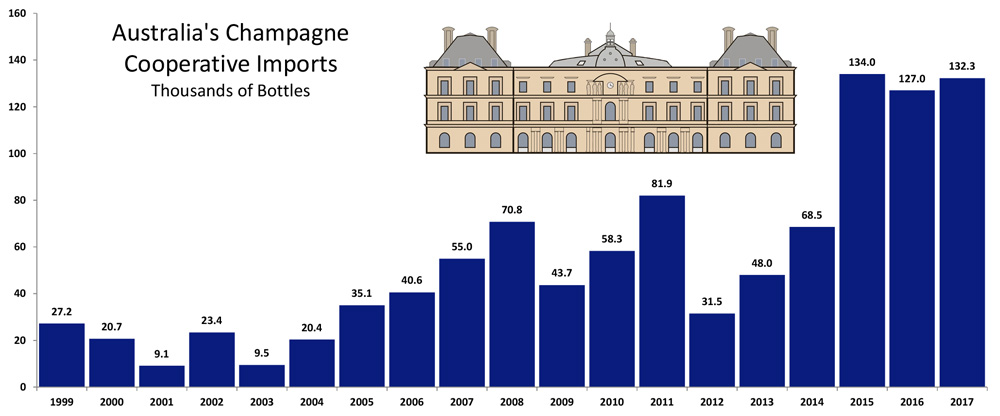

Australia’s thirst for champagne seemingly knows no bounds, and after fifteen years of strong growth, 2017 has hit a new high as a record-smashing year for champagne consumption down under.

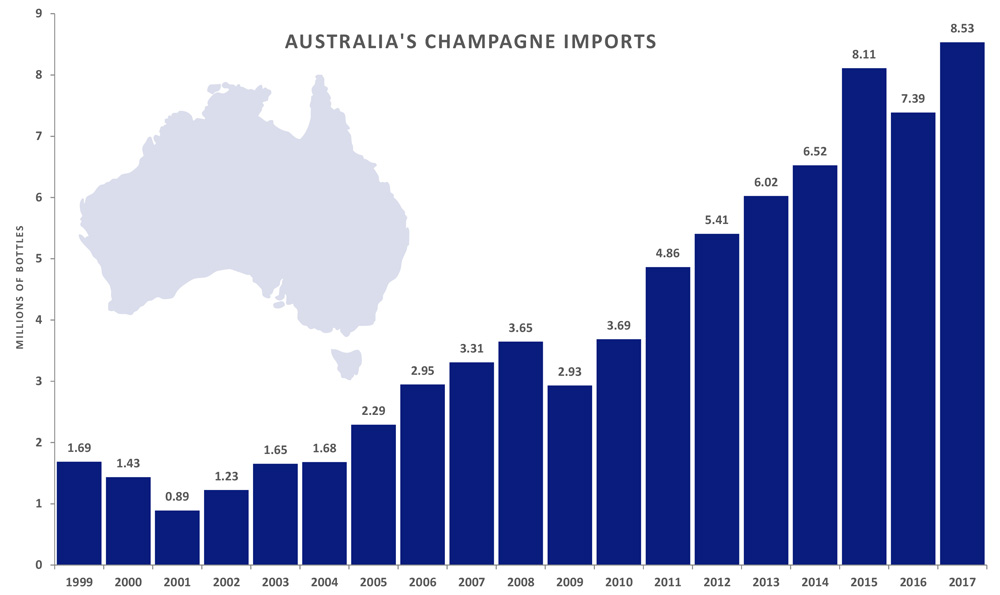

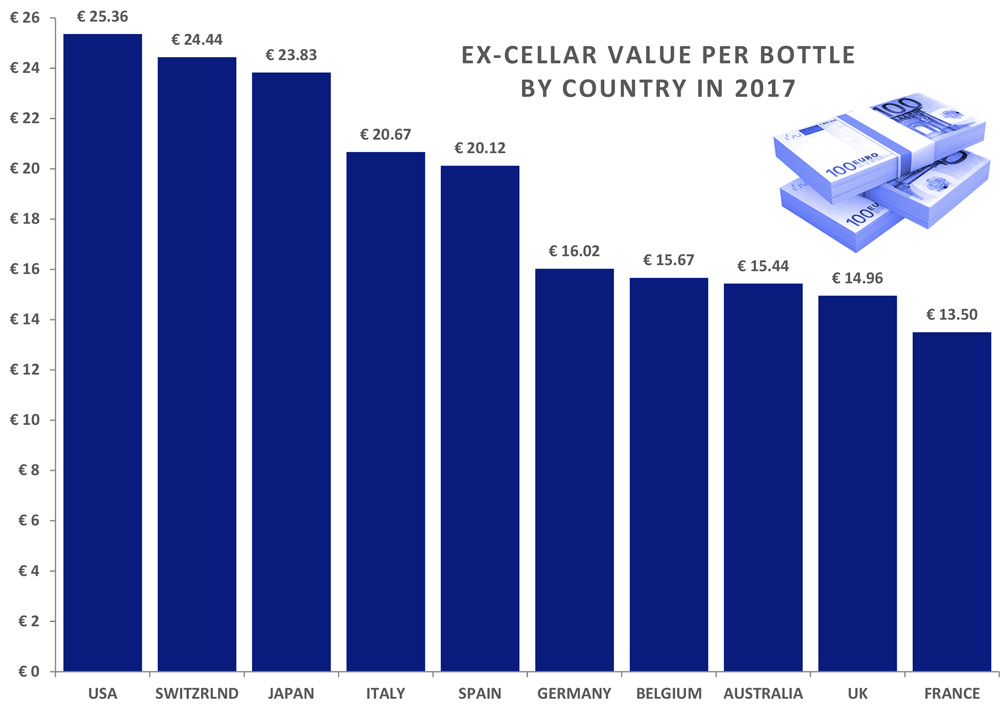

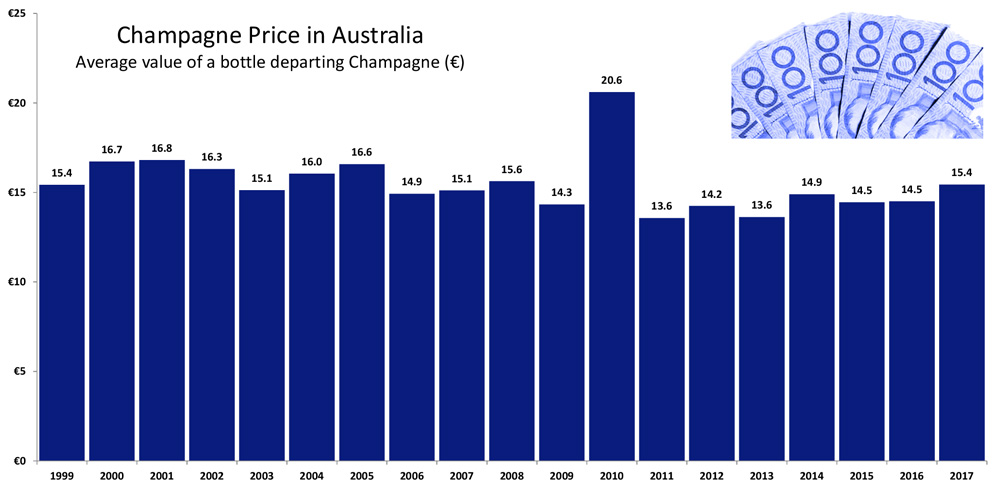

An all-time record 8.53 million bottles were popped in 2017, a huge 16% up on 2016. The explosion in ex-cellar value was larger still, mushrooming 23% to a record €131.7M, particularly noteworthy against a less favourable exchange rate. This unprecedented growth positioned Australia as the fastest-growing of champagne’s top ten markets by both volume and value in 2017.

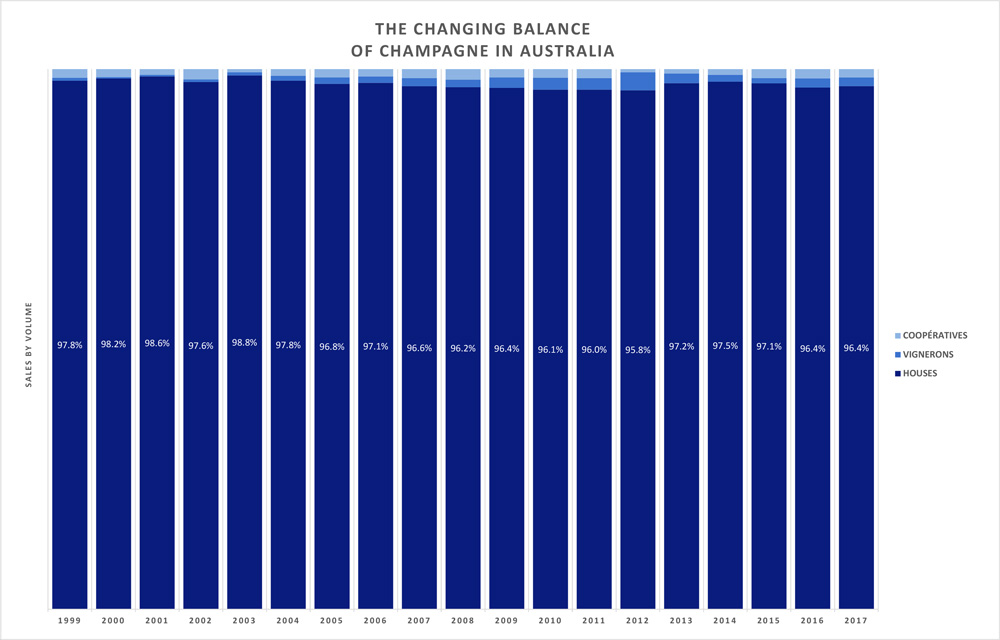

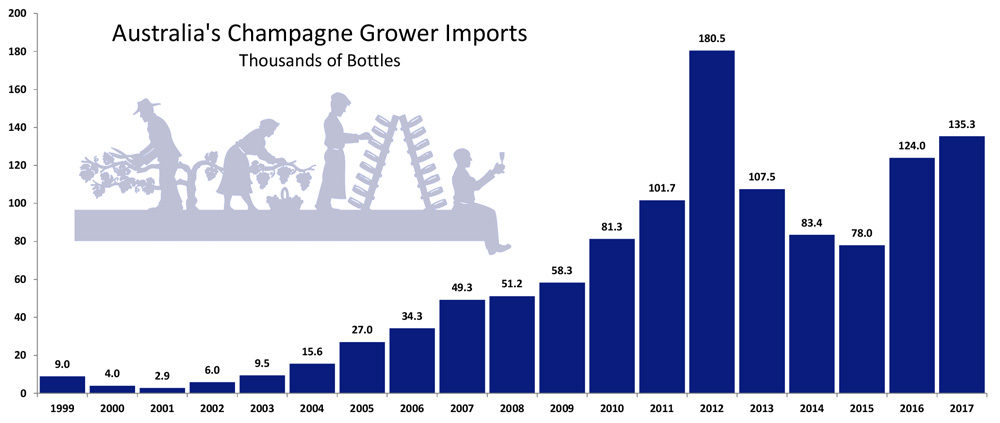

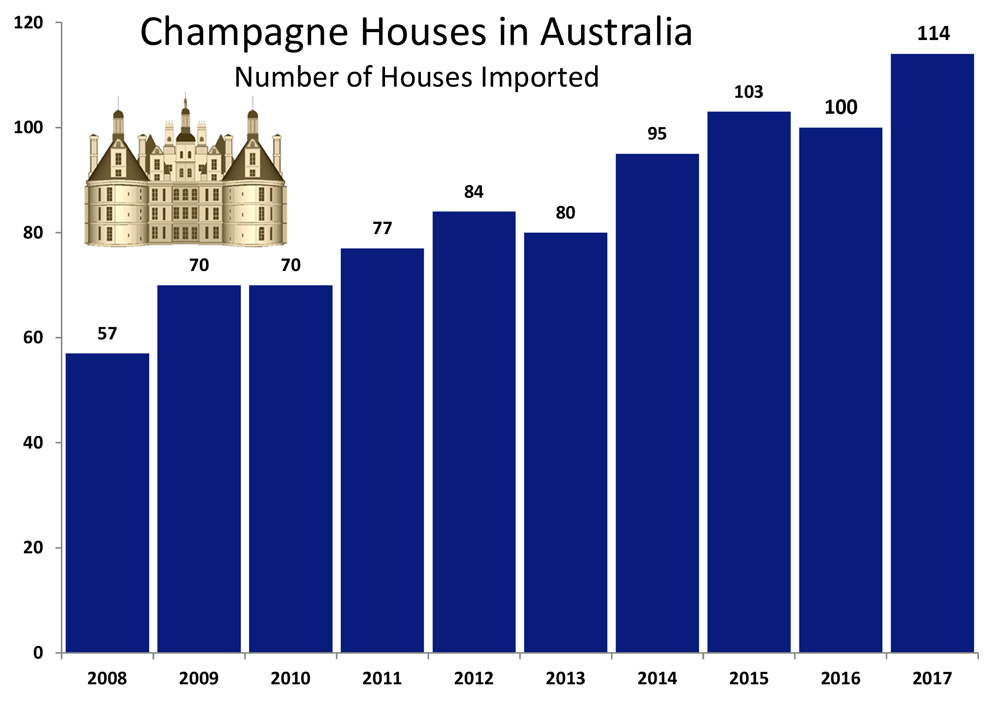

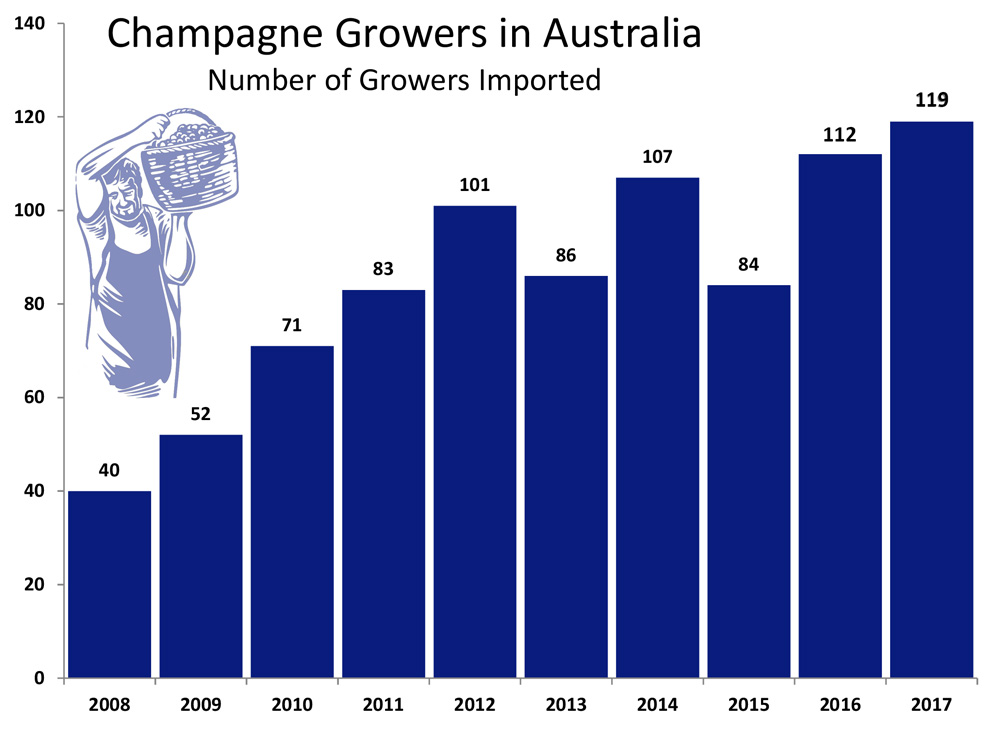

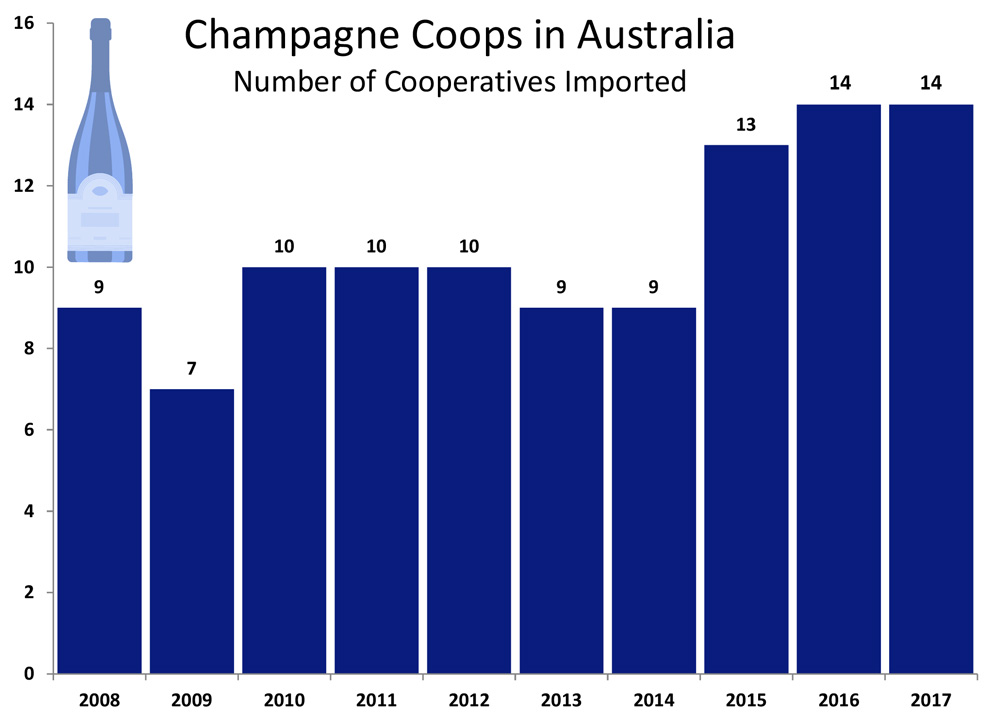

The year also saw a rise in the diversity of champagne available in Australia. A record 114 champagne houses, 119 growers and 14 cooperatives were imported in 2017.

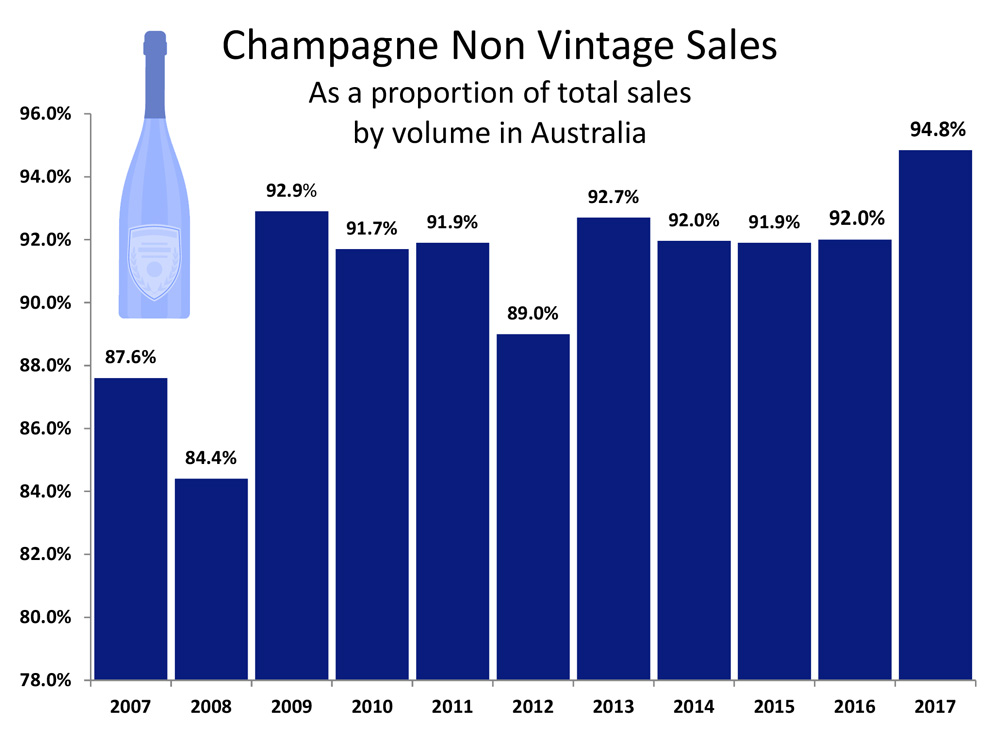

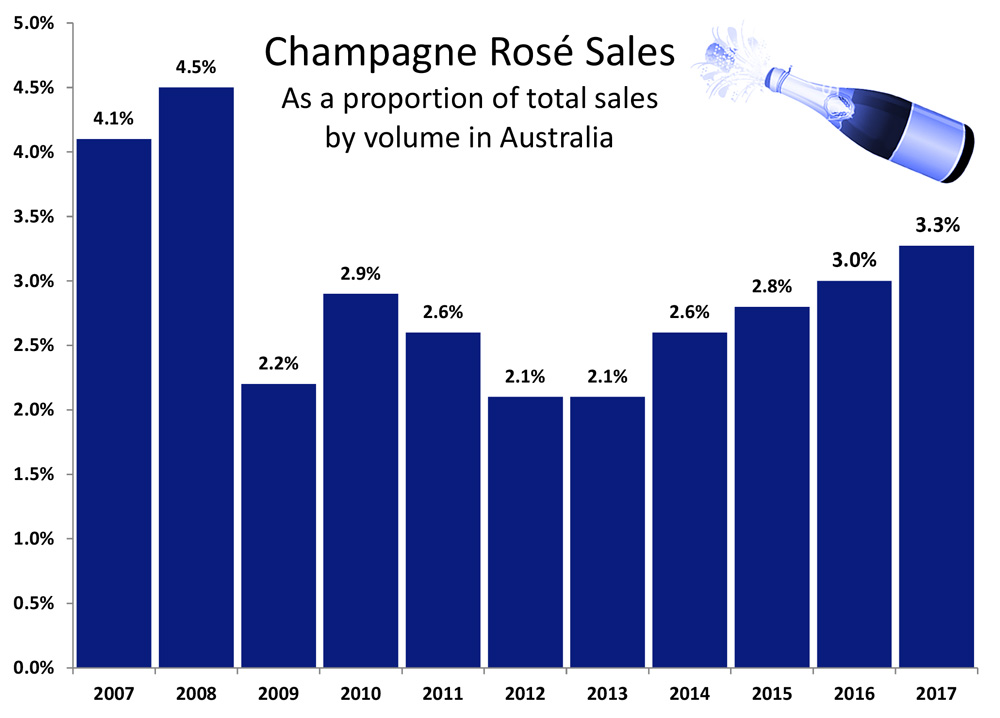

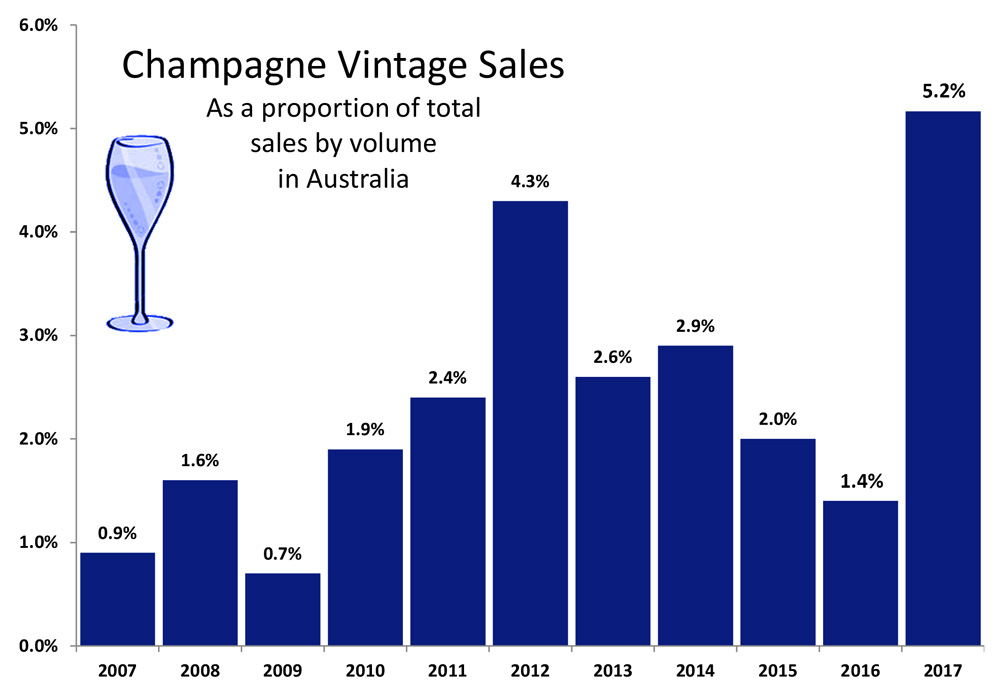

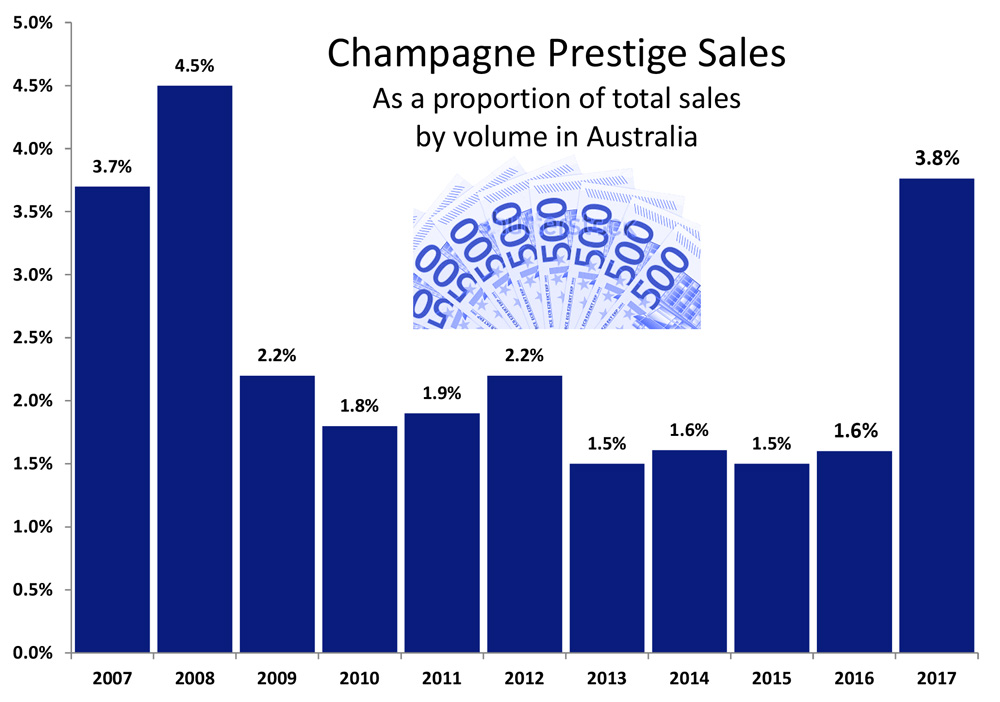

A market notoriously dominated by entry-level non-vintage cuvées, 2017 saw a marked rise in prestige cuvée and rosé imports to their highest levels in a decade, coinciding with an unprecedented high for vintage cuvées.

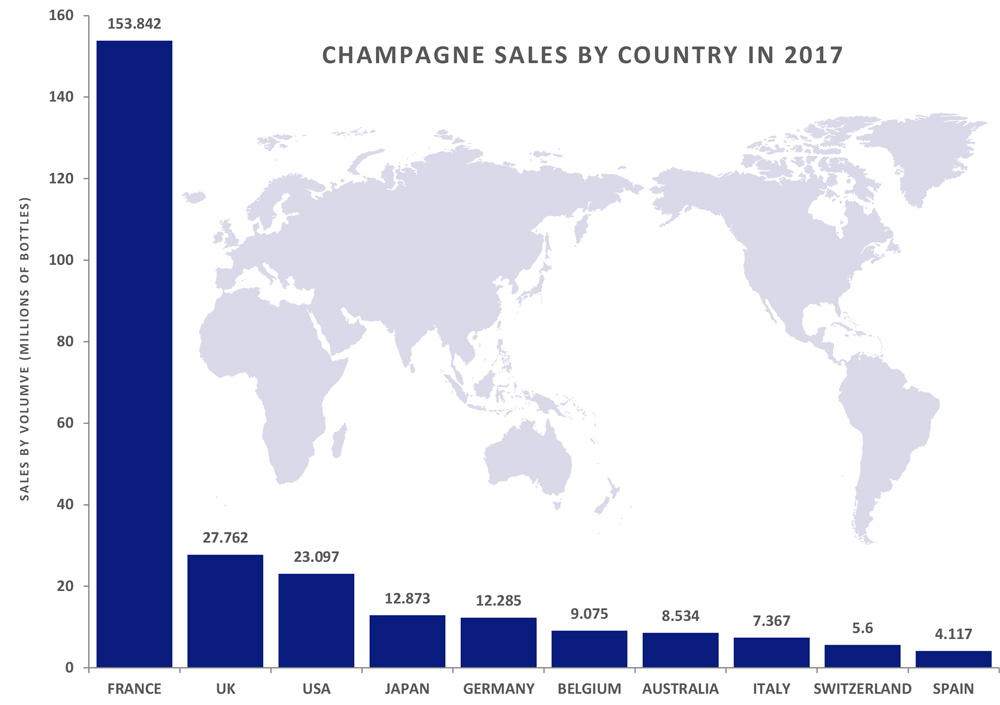

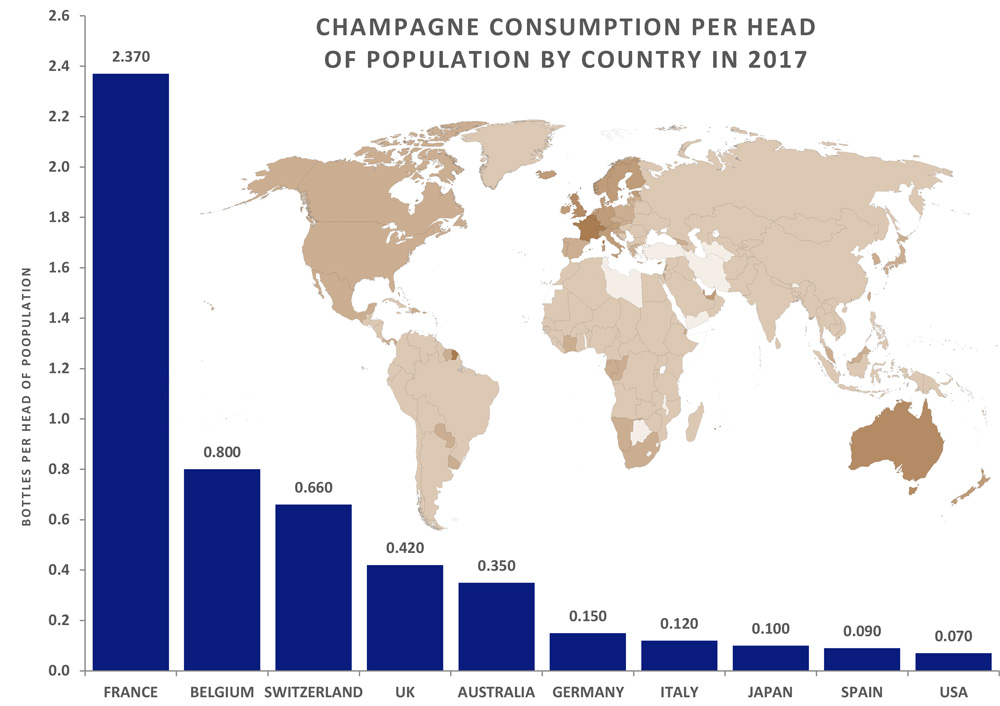

Australia confidently holds its position as the world’s seventh largest champagne market, with the biggest consumption per head of population outside Europe.

Since 2001, Australia’s champagne imports have grown almost ten-fold.

‘Australia is riding a 16-year-long champagne high!’ suggests Tyson Stelzer, author of The Champagne Guide and host of the Taste Champagne event series. ‘Our palates have matured, we’re spending more on a bottle of wine, and champagne is no longer a special occasion luxury but an everyday indulgence.’

Stelzer cautions not to read Australia’s unprecedented growth in champagne imports in 2017 on face value. ‘There is something of “pipeline filling” effect at play here,’ he explains. ‘A sharp rise in imports in 2015 overstocked Australia’s champagne warehouses, corrected by a decline in 2016, and in turn compensated in 2017. Australia’s 2017 import figures were consistent with its long-term annual average growth of 15% since 2001.’

Growth in its export markets in 2017 accounted for a new record in Champagne’s total turnover of €4.9 billion.

‘Compared with 2016 when turnover growth was driven by the diversification of cuvées, markets where Champagne enjoys a high level of valorisation have delivered strong returns, explaining the new record set in 2017 thanks in particular to the United States, Japan and Australia,’ said Comité Champagne Director of Communication, Thibaut Le Mailloux.

While Australians are indulging in more champagne than ever before, Stelzer points out that there is much work still to be done in introducing the full diversity of styles that Champagne has to offer.

‘Champagne houses comprise more than 96% of Australian champagne consumption, leaving just 1.6% to growers and 1.5% to cooperatives,’ Stelzer highlights. ‘The five biggest houses dominate more than 75% of the market.’

Stelzer launched Taste Champagne in 2014 as a showcase for media, wine trade and the champagne-loving public to experience the full diversity of champagne. Over the past five years, the event series has grown to become the largest champagne showcase on earth. In August 2018, Taste Champagne will open hundreds of cuvées in Sydney, Canberra, Brisbane, Perth, Melbourne and, for the first time, Adelaide.

The first round of more than 50 houses, growers and cooperatives to sign up for Taste Champagne has been announced at http://tastechampagne.com.au/, with more confirming their involvement every week.

Statistics compiled by Tyson Stelzer from data presented in Les Expéditions de Vins de Champagne en 2017, 2016, 2015, 2014, 2013, 2012, 2011, 2010, 2009 and 2008, Comité Champagne.